Financial Derivatives: A Quantitative Finance View

Loại khoá học: Investing & Trading

The financial engineering of forwards, futures, swaps, and options, with Python tools for fixed income and options

Mô tả

Student Testimonials:

This course offers an unreal value. Very rich content! This beats any financial course I've taken at my university. Looking forward to completing this course and using some of these skills in my career.--Steven

Cameron is an outstanding teacher. Thank you very much for making the most important and difficult Finance concepts so easy to understand. Looking forward to the further courses.--Gevorg

I got (am getting) some intuition about quant finance, not just leaning facts without really understanding the concepts.

Cameron gives nice detailed answers to students questions.--Rich

Interested in a lucrative and rewarding position in quantitative finance? Are you a quantitative professional working in finance or a technical field and want to bridge the gap and become a full on quant? Then read on.

The role of a quantitative analyst in an investment bank, hedge fund, or financial company is an attractive career option for many quantitatively skilled professionals working in finance or other fields like data science, technology or engineering. If this describes you, what you need to move to the next level is a gateway to the quantitative finance knowledge required for this role that builds on the technical foundations you have already mastered.

This course is designed to be exactly such a gateway into the quant world. If you succeed in this course you will become a master of quantitative finance and the financial engineering of the most influential class of financial products that exist on markets today: derivatives.

About the instructor:

This course was created by a mathematician and financial quant holding a Ph.D. from the Courant Institute of Mathematical Sciences at NYU, and who earned his quant chops on Wall Street after an accomplished career as a theoretical materials scientist.

The focus of the course is thus very much on the practical skills someone working in the trenches in the real world of finance needs to have. But since the course author also has 10 years of college teaching experience, it is taught with an eye to sound course structure and sensitivity to the concerns of students.

What you will learn:

Many finance students and professionals find derivatives the most challenging subject in their field. But if you have a background in quantitative fields like statistics or computer science this course will show you that these most daunting of financial products are completely accessible to you.

Even if you are completely new to the world of finance, after completing this course you will have a deep mastery of the fundamental derivative structures traded on markets today: forwards, futures, swaps, and options. But since this course is presented by a practitioner you will also learn how derivatives are actually used in the real world, as tools for both speculation and risk management.

The world of finance and markets is fast-paced and exciting, but can also be very intimidating. In the heat of the moment, the markets are volatile and unpredictable, positions go south in unanticipated ways, you have traders yelling at you, you have computer software failing, you're relying on data you can't trust. Keeping your head above water in this environment can be well nigh impossible.

You need a conceptual framework that allows you to keep above the fray and keep your wits about you. In this course, my primary purpose is to convey that conceptual framework to my students. The same conceptual framework that allowed me to survive and thrive in the pits of Wall Street during the dark days of the financial crisis.

Concerned that you may not have the required background to succeed in this course? As long as you meet the formal prerequisites you need not be. A quantitatively strong business background is more than enough to meet these requirements. Any decent course in statistics and the basics of calculus is enough. In truth, high school mathematics is all that is needed for 80-90% of the course material. The most important requirement is simply to think analytically and logically.

Here is a sampling of some of the main topics that we'll cover on your journey into the quant profession:

Interest rate fundamentals

Periodic and continuous compounding

Discounted cash flow analysis

Bond analysis

The fundamentals of equity, currency, and commodity assets

Portfolio modelling

Long and short positions

The principle of arbitrage

The Law of One Price

Forwards, futures, and swaps

Risk management principles

Futures hedging

Stochastic processes

Time series concepts

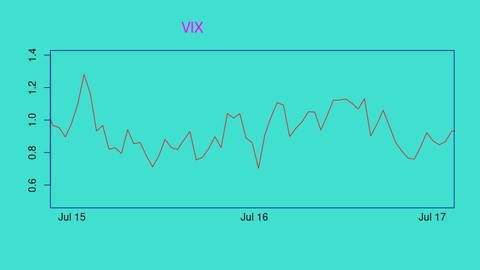

The real statistics of asset prices: volatility clustering and autocorrelation

Fat-tailed distribution and their importance for financial assets

Brownian motion

The log-normal model of asset prices

Options

Put-call parity

The binomial model of option pricing

The Black-Scholes theory and formula

Option greeks: delta, gamma, and vega

Dynamic hedging

Volatility trading

Implied volatility

Includes Python tools

Python based tools are now included for computations with bonds, yield curves, and options. All software that is part of this course is released under a permissive MIT license, so students are free to take these tools with them and use them in their future careers, include them in their own projects, whether open source or proprietary, anything you want!

So Sign Up Now!

Accelerate your finance career by taking this course, and advancing into quantitative finance. With 23 hours of lectures and supplemental course materials including 10 problem sets and solutions, the course content is equivalent to a full semester college course, available for a fraction of that price, not to mention a 30 day money back guarantee. You can't go wrong!

Bạn sẽ học được gì

Learn the fundamentals of derivatives at a quantitative level

Master arbitrage, the core principle underlying derivatives, quantitative risk management and quantitative trading

Use derivatives to control and manage financial risk

Price forwards, futures, swaps and options

Understand the Black-Scholes theory and formula intuitively, avoiding stochastic calculus

Learn the limitations of the Black-Scholes theory, and how it is used in practice

Python based tools are provided for computations with bonds, yield curves, and options

Yêu cầu

- Calculus and a basic course in probability and statistics

- No knowledge or background in finance is assumed

Nội dung khoá học

Viết Bình Luận

Khoá học liên quan

Đăng ký get khoá học Udemy - Unica - Gitiho giá chỉ 50k!

Get khoá học giá rẻ ngay trước khi bị fix.

Đánh giá của học viên

Bình luận khách hàng