A Primer on Quant Trading

Loại khoá học: Investing & Trading

Everything you need to know to get started as a quant trader

Mô tả

In this course, we put a definite emphasis on real-world cases and hands-on experience. Each section starts with an analysis of tick data and/or a numerical simulation, from which we develop an intuition for what the right approach should be. You get to download the Python scripts and data samples, and start experimenting with them right away.

Then, we introduce theoretical tools and models as needed -- always explained from first principles and fully worked-out computations -- in order to solve the particular problem studied in the section and get a deeper understanding of all its aspects.

Let’s dive right in!

Contents:

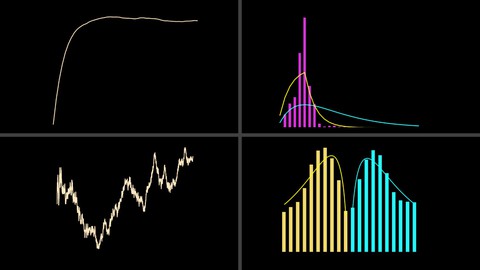

Order book: Statistics, Dynamics, and Modeling

1.1 Book size and shape — empirical observations

1.2 Diffusion models of the order book

1.3 The Bouchaud-Mézard-Potters model

Liquidity Provision: Market-Making and the Avellaneda-Stoikov Model

2.1 A basic market-making strategy; Fundamental rules of market-making

2.2 The Avellaneda-Stoikov model

Market Impact, Spread, Liquidity

3.1 Measuring market impact on trade data

3.2 A simple market impact model without feedback

3.3 A comprehensive model with feedback

Optimal Execution

4.1 The liquidation problem: numerical experiments

4.2 The case without drift: a stochastic control approach

4.3 The case with drift

Bạn sẽ học được gì

Learn the fundamentals of quantitative trading

Analyze liquidity and market impact from tick data

Understand optimal execution of orders

Master the mathematical foundations of quant trading

Yêu cầu

- Basic Python

- Calculus

Nội dung khoá học

Viết Bình Luận

Khoá học liên quan

Đăng ký get khoá học Udemy - Unica - Gitiho giá chỉ 50k!

Get khoá học giá rẻ ngay trước khi bị fix.

Đánh giá của học viên

Bình luận khách hàng